Hello! You know what, this type of investing is really great. Once you start with dividends and with longterm vision, then it is very easy to follow and time is money :-) .

I can imagine writing this article for 2023 with same attitude, as first dividends are rolling into my account and I own also couple stocks, that are outperforming indexes, so it is very positive combination.

Let's have a look on my transactions during November

I bought new stock $PTVE , it is also IPO stock from 2020, so when I mean new, it's really in all way :-) . Then I added couple stocks into old cyclical $AEO , which really did a big impact on portfolio performance, as this stock is now around 16$ ! I know, they skipped last dividend payout, but I am ready to sell this stock with 100% gain and buy it back, when it will drop below 11-12 , as it did many times before (zoom out your charts - use weekly/monthly timeframe)

This chart is looking funny, but I see it in one year and I am sure, this will be outperformed many times, slowly compounding, reinvesting, money generating money! I love it.

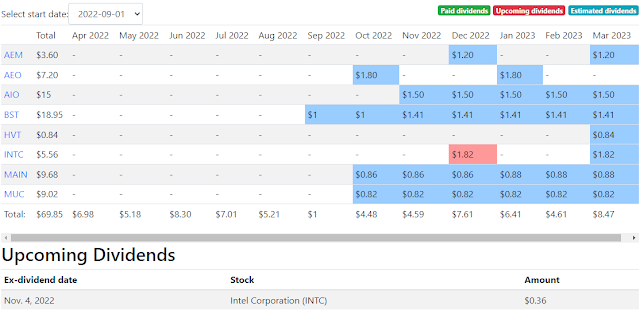

I have short list of stocks, I might buy this month, I want first transfer money from my income (200-230$), trading account (7$) , plus received dividends (10$) and couple bucks from last month transaction, which I didn't use (20$) , this gives me buying "power" around 250$ for this month.

Projected dividend income is looking better not every month, but almost every week, as companies are increasing dividend amount paid to their stockholders - see last row at the bottom, 18$ in dividends for this month! In March it is 18,10$ , in June 18,34$ , small but steady + my additional deposits, it be soon above 25$ :-) / month . And my modest goals for 2023 is to achieve at least one month with 40$ in dividends and 250$ / year , so I will do my best to achieve it.